In in the present day’s quick-paced world, monetary emergencies can come up unexpectedly, leaving people in need of quick money options. For a lot of, payday loans with no credit check have emerged as a viable possibility. This article delves into the necessity of such loans, exploring their benefits, dangers, and the situations where they generally is a helpful useful resource.

Understanding Payday Loans

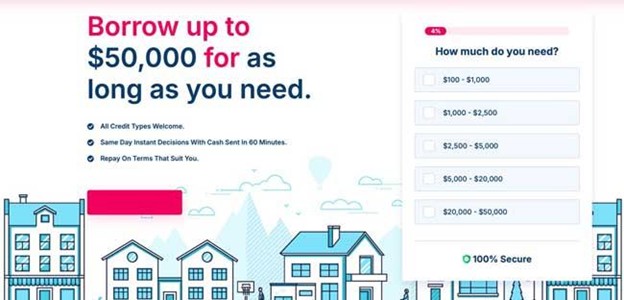

Payday loans are short-term, excessive-curiosity loans designed to supply quick cash to borrowers who need funds before their subsequent paycheck. Typically, these loans are small, typically ranging from $one hundred to $1,000, and are intended to cowl urgent expenses comparable to medical payments, car repairs, or unexpected family costs. One of the crucial interesting facets of payday loans is the speed at which borrowers can access funds, usually within a single enterprise day.

The Position of Credit score Checks

Many traditional lenders conduct credit score checks to assess a borrower’s creditworthiness earlier than approving a loan. These checks can be a major barrier for individuals with poor credit histories or those who’ve never established credit. In distinction, payday loans with no credit check allow individuals to bypass this hurdle, making them accessible to a broader range of borrowers. This function is especially beneficial for individuals who might have skilled monetary difficulties up to now, resulting in a low credit rating.

Who Wants Payday Loans with No Credit Check?

- People with Poor Credit Histories: For many, life circumstances can result in monetary setbacks, leading to a low credit score. Traditional lenders might deny loans based on these scores, leaving people with limited options. Payday loans with no credit check present an opportunity for those in this situation to access funds when wanted.

- Unexpected Expenses: Emergencies can come up at any time, and not everyone has a monetary cushion to fall back on. Whether it is a automotive breakdown, medical emergency, or unexpected dwelling restore, payday loans can provide fast relief when time is of the essence.

- Job Seekers: Individuals who are currently unemployed or seeking new employment might wrestle to cowl quick living expenses. A payday loan will help bridge the hole till they secure a stable income.

- College students: School students often face financial challenges, particularly those who’re dwelling on tight budgets. Unexpected expenses can occur, and payday loans can provide a solution to cover these costs without the need for a credit check.

Benefits of Payday Loans with No Credit Check

- Fast Entry to Cash: One in every of the primary advantages of payday loans is the pace at which borrowers can obtain funds. Many lenders can course of applications and disburse money within hours, making it a wonderful choice for these in pressing need.

- Simplified Utility Course of: The applying course of for payday loans is typically simple and requires minimal documentation. Borrowers often only need to provide proof of earnings and identification, making it accessible for many.

- No Credit Limitations: As previously mentioned, the absence of a credit check signifies that individuals with poor credit histories should not automatically disqualified from receiving funds. This inclusivity could be a lifeline for a lot of.

- Flexible Repayment Choices: Many payday lenders provide flexible repayment terms, permitting borrowers to decide on a repayment schedule that aligns with their monetary scenario. This flexibility may also help individuals handle their repayments extra successfully.

Risks Involved

Whereas payday loans with no credit check can be beneficial, additionally they include inherent dangers that borrowers should consider:

- Excessive-Curiosity Charges: Payday loans are infamous for their high-curiosity rates, typically exceeding 400% APR. This can lead to a cycle of debt if borrowers are unable to repay the loan on time.

- Short Repayment Phrases: Most payday loans require repayment within just a few weeks, typically coinciding with the borrower’s subsequent paycheck. If a borrower can’t repay the loan today no credit check in full, they could also be forced to take out another loan, resulting in extra charges and curiosity.

- Potential for Debt Cycle: The ease of acquiring payday loans can lead to a cycle of borrowing, where people frequently take out new loans to pay off previous ones. This will create an unsustainable financial scenario.

- Impression on Future Credit score: Whereas payday loans don’t contain credit score checks, failure to repay them can result in collections and negatively impact a borrower’s credit score in the long term.

Making Knowledgeable Selections

Earlier than considering a payday loan with no credit check, it is crucial for borrowers to judge their monetary state of affairs totally. Listed below are some steps to take:

- Assess Financial Needs: Decide the precise quantity needed and whether a payday loan is the most effective option. Consider alternative solutions, resembling personal loans no credit check loans from credit score unions or borrowing from buddies and family.

- Analysis Lenders: Not all payday lenders are created equal. Research potential lenders, read critiques, and guarantee they are reputable and licensed to function in your state.

- Perceive the Terms: Before signing any agreement, fastidiously read the phrases and circumstances. Bear in mind of the curiosity rates, fees, and repayment schedule.

- Plan for Repayment: Have a clear plan for find out how to repay the loan on time. Consider how it will fit into your budget and whether or not you may afford the repayments with out further straining your finances.

Conclusion

Payday loans with no credit check can present a needed financial lifeline for people facing unexpected expenses or financial emergencies. Nevertheless, it’s essential for borrowers to method these loans with warning, understanding the potential risks and making informed decisions. By doing so, they will utilize these loans as a sensible resolution whereas minimizing the possibilities of falling right into a cycle of debt. If you have any questions concerning exactly where and how to use approved loans no credit check (youlink.ink), you can contact us at our own web page. In a world where financial stability is more and more challenged, payday loans can serve as a instrument for those in want, supplied they are used responsibly.